GiftVal is designed for valuing gifts for tax purposes, specifically generating ready-to-file reports for IRS Form 709. It’s very similar to EstateVal, so a good starting point to learning GiftVal is to read the introduction to EstateVal.

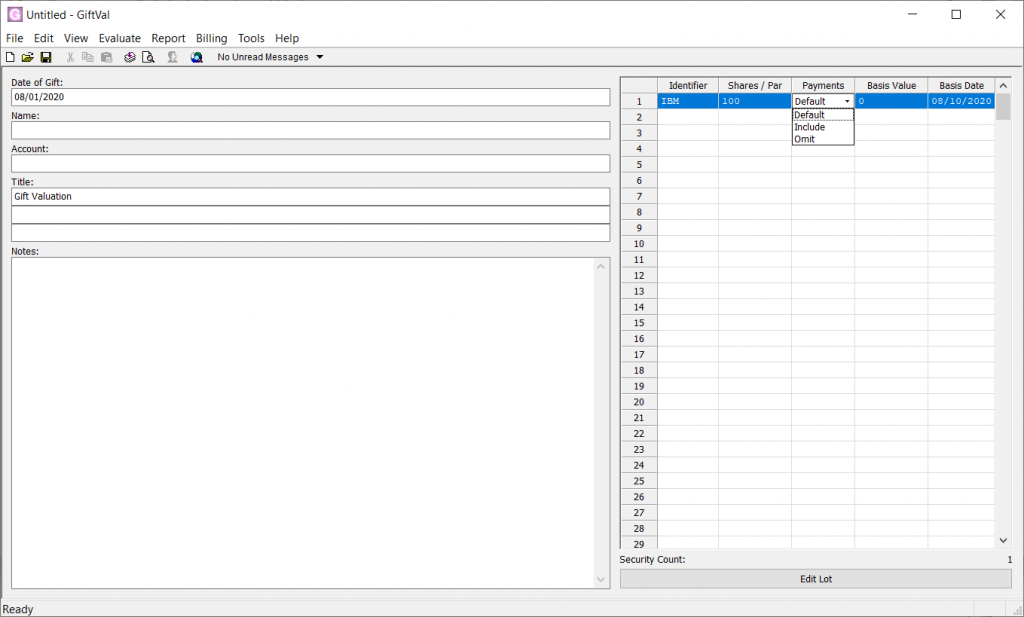

Using GiftVal differs from EstateVal mostly in what gets entered into the Grid. Where EstateVal has columns for the security identifier and the shares / par of each holding, GiftVal adds three more: Payments, Basis Value, and Basis Date.

Payments determines if payments for the lot are included in the value on the report. For each lot in GiftVal, you can specify if payments are explicitly included with the gift, explicitly omitted from the gift, or if they are included or omitted according to the default behavior of the software.

Which setting is correct? It depends on the circumstance, but in general, if the security will be owned by the recipient, and the payment will go to them, then it will be included and considered part of the gift. If the security’s ownership is still with the grantor and they will receive payment, then the item is omitted as it is not part of the gift.

For instance, using the default behavior, if a dividend has gone “of-record” but not yet been paid, then it will not be included in the gift. The grantor was the owner of the security when it went of-record, so the check for the payment will be sent to him or her, meaning it was not part of the gift. Alternately, partial accruals are, by default, included in the gift, since they— and the rest of the accrual for the coupon—will be mailed to the recipient, as they will be the owner when the period ends. (For a specific list of how each security type is treated, see below, under “Stocks” and “Bonds”.)

The “Default” behavior is what EVP Systems considers the right thing to do, for any given circumstance. But you can make this decision explicitly on a per-lot basis, by changing the drop-down as needed, accounting for unusual or unexpected circumstances.

If a payment is excluded from the value of the gift, it can still be shown on the report, according to the Note for Omitted Dividends and Note for Omitted Accruals preferences set in the Tools → Options... → Report dialog. This makes it easy to see what is and isn’t included as part of the value of the gift—payments not included in the value are explicitly labelled “Omitted.” But if you prefer to simply leave them off—as if they never existed — you can edit these preferences to change the report.

Basis Value and Basis Date are informational only—if they are entered, they will be included with each lot on the report, to add some history to the security that’s being gifted. Otherwise, they’re excluded.

GiftVal also supports an Appraisal report. This is identical the the Appraisal Date report that EstateVal can produce, and is included for convenience.

Because gifted portfolios are only valued for a single date, there are no adjusted inventories in GiftVal, though prices can be entered manually (the same way they can in EstateVal) using the Edit Lot button at the bottom of the Grid.

“Stocks” and “Bonds”

GiftVal divides all the security types it knows about into the broad categories of “stocks” and “bonds” when it’s deciding if it should include or omit the payments from the report. Here are all the security types considered “stocks”:

- Stock

- Mutual Fund

- Common Trust Fund

- Unit Investment Trust

- Limited Partnership

- Text

- Text and Shares

- Index

And these are the security types considered “bonds”:

- Corporate Bond

- Municipal Bond

- Treasury Bond or Note

- Bond (Generic Accrual)

- Mortgage Backed Security

- Treasury Bill

- Savings Bond, Series E/EE

- Savings Bond, Series H/HH

- Savings Bond, Series I

- Certificate of Deposit (Short Term)

- Certificate of Deposit (Long Term)

- Savings Note

Reports

Like EstateVal, GiftVal’s reports can be saved from their Print Preview screen as text (.TXT), word processor files (.RTF), PDFs (.PDF) and Excel (.XLSX) spreadsheets, just by using the appropriate buttons in the title bar.

The data can also be exported as “Excel (XSLX)” and “Excel (XSLX, Simple)” by setting the Type selection in the Tools → Options... → Export dialog box, and using File → Export → From Files → [Report Type]… menu item.